UX Workflow: Digitalization of Power of Attorney Form Request

Introduction

This document outlines a user-centered UX process for a “Power of Attorney Form Request” in the context of U.S. Bank, specifically tailored for dealership users. It is based on a real-world project I worked on as a UX Designer, focusing on streamlining the user journey for dealership representatives requesting or managing a Power of Attorney (POA) form.

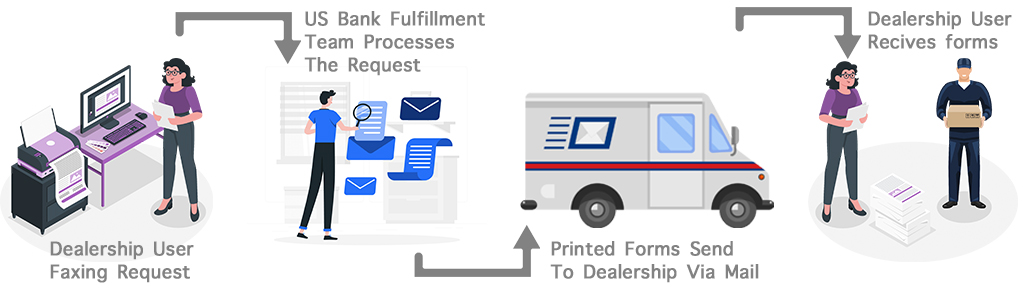

Previously, dealership users had to request a “Power of Attorney” (POA) form from the US Bank fulfillment team by sending a physical request via fax or mail. This manual process was time-consuming, prone to errors, and inefficient.

1. Understanding the Manual Process (Pre-Digital)

-

Manual Form Request: Dealership representatives would contact their U.S. Bank relationship manager via phone or email to request a POA form.

-

Form Distribution: The POA form would be shared as physical mail.

-

Form Completion: Dealership representatives had to manually complete the form, ensure all required signatures were obtained, and gather any supporting documents.

-

Form Submission: Forms were physically mailed or Fax and emailed back to the bank.

-

Processing & Confirmation: Processing was slow, with back-and-forth communication for corrections. Confirmation was provided by email or phone.

Objective

To eliminate the need for fax or mail-based requests by integrating a digital form request system within the dealership portal, allowing users to access and submit POA form requests online.

2. Research & Discovery

Objective: Understand user needs, regulatory requirements, and pain points in the existing POA process for dealership users.

-

-

Project Scope:

-

Streamlining the existing POA form request process for dealership users on U.S. Bank’s digital platform.

-

Ensuring compliance with legal requirements while enhancing user experience.

-

-

Research Methods:

-

User Interviews: Engaged with dealership representatives who had previously requested a POA.

-

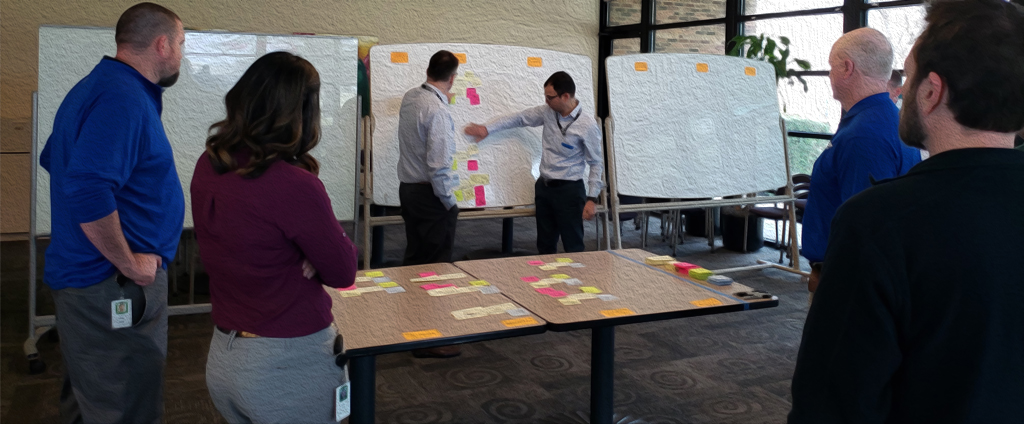

Stakeholder Workshops: Collaborated with legal, compliance, and customer support teams.

-

Heuristic Analysis: Evaluated the existing manual form request process.

-

-

3. User Research Synthesis

Following the user research phase, the team systematically analyzed the findings by creating an Affinity Map and a series of Experience Maps.

This structured approach allowed us to:

Identify patterns and themes across user behaviors, pain points, and needs.

Distill key insights that highlight critical areas for improvement.

Uncover opportunities to enhance the user experience by addressing gaps in the current process.

By synthesizing these insights, we established a clear direction for design improvements, ensuring our solutions align with real user needs and expectations.

UX Decision On Feature Implementation

Given that the business line requested full implementation of all identified features and the functional team raised no feasibility concerns, the team determined that feature prioritization was unnecessary. Instead of using a prioritization matrix, the focus shifted to ensuring seamless integration and execution of all proposed features while maintaining an optimal user experience.

Scenario & Persona Development

Five key scenarios were created from the synthesis. A persona representing a typical dealership user was developed to understand user goals and frustrations.

Problem Statements

Each scenario had a “How Might We” problem statement to guide design ideation and user flow development.

Design Studio & Benchmarking

The team sketched concepts for each scenario, evaluated them, and selected the most viable ideas.

User Flows

A “happy path” user flow was created for each scenario to guide prototype development.

Prototype Testing

A paper prototype was created and tested successfully, providing valuable insights and validating the user flows and design concepts.

4. User Flow Design

Current Workflow (Before Digitalization)

1.User fills out a paper POA request form. 2.User sends the form via fax/mail to the US Bank fulfillment team. 3.The fulfillment team processes the request and prints the POA form. 4.The printed form is sent back to the dealership via mail. 5.User receives the form and completes the required actions.

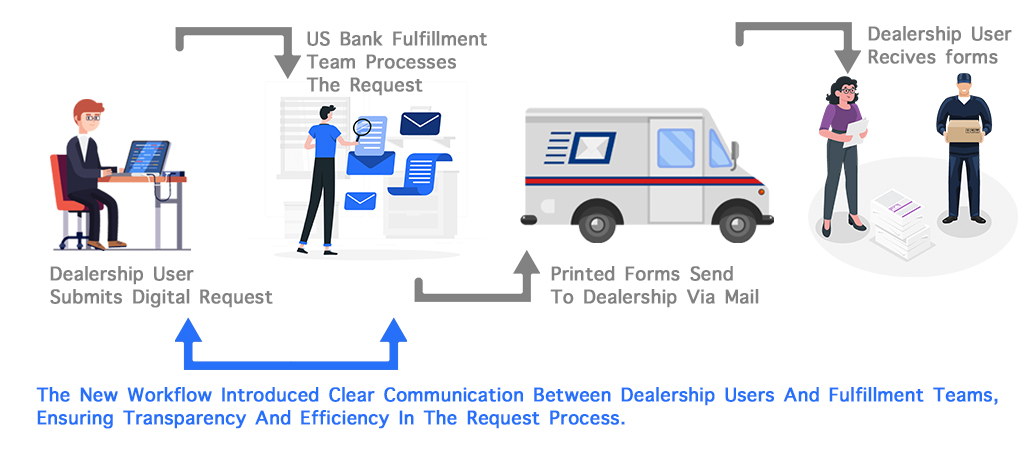

Proposed Digital Workflow

1.User Login. 2.Navigate to POA Request Section. 3.Fill Out Digital Form. 4.Submit Request. 5.Fulfillment Team Review. 6.Decision Making: Approve / Reject / Request More Details. 7.Dealer Notification. 8.The printed form is sent back to the dealership via mail. 9.User receives the form and completes the required actions.

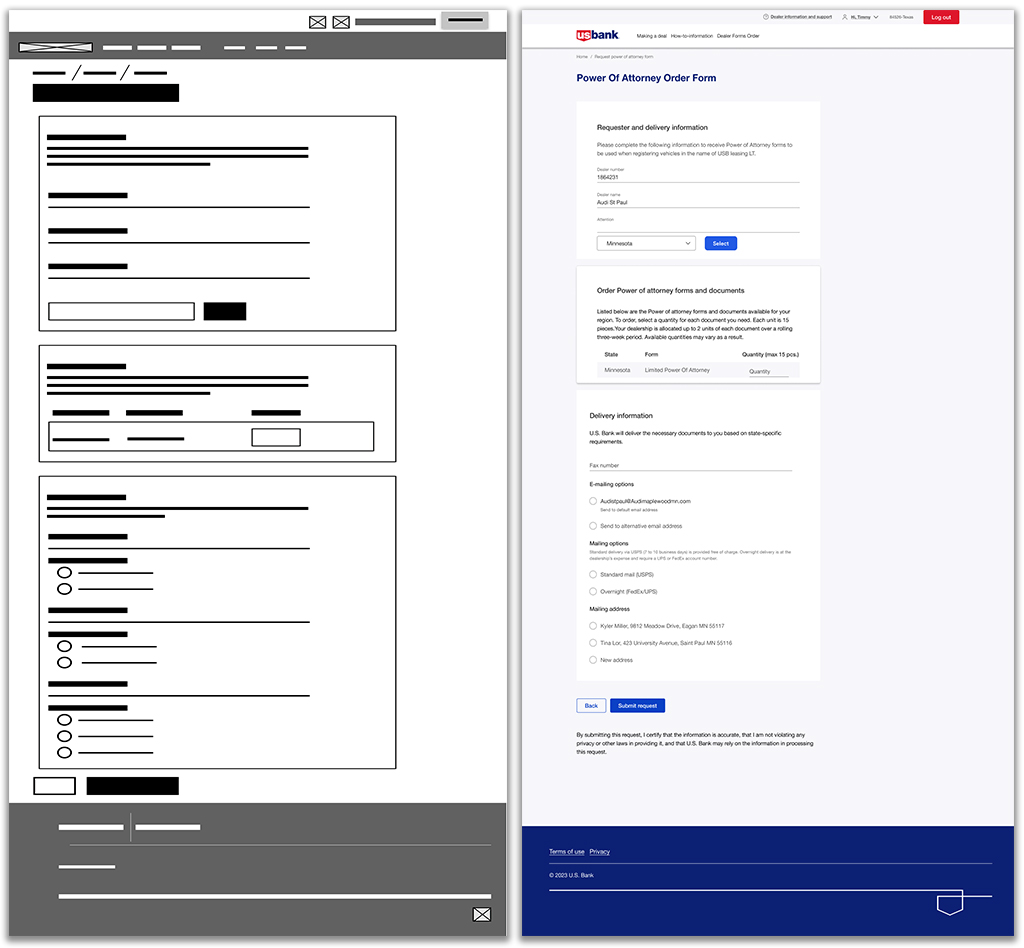

5. Wireframing & Prototyping

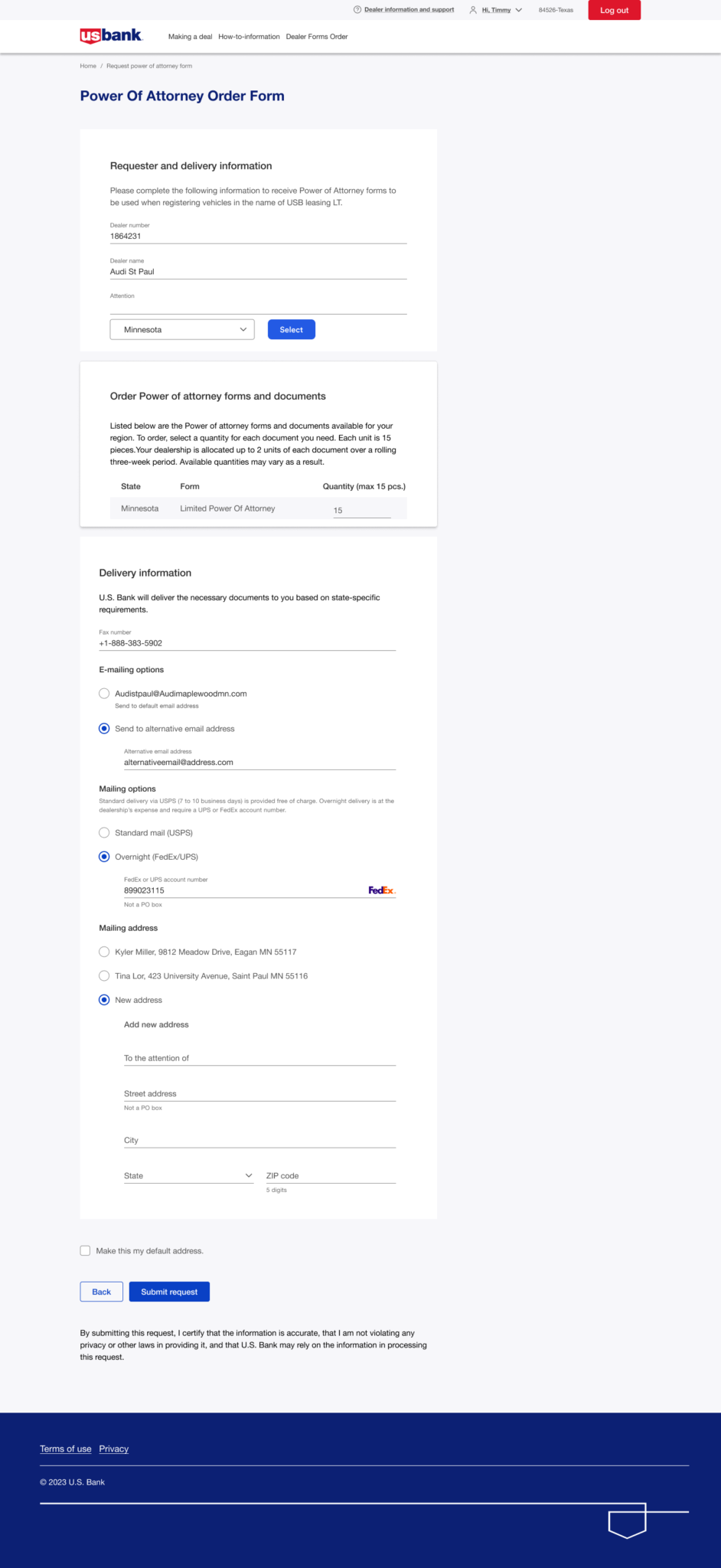

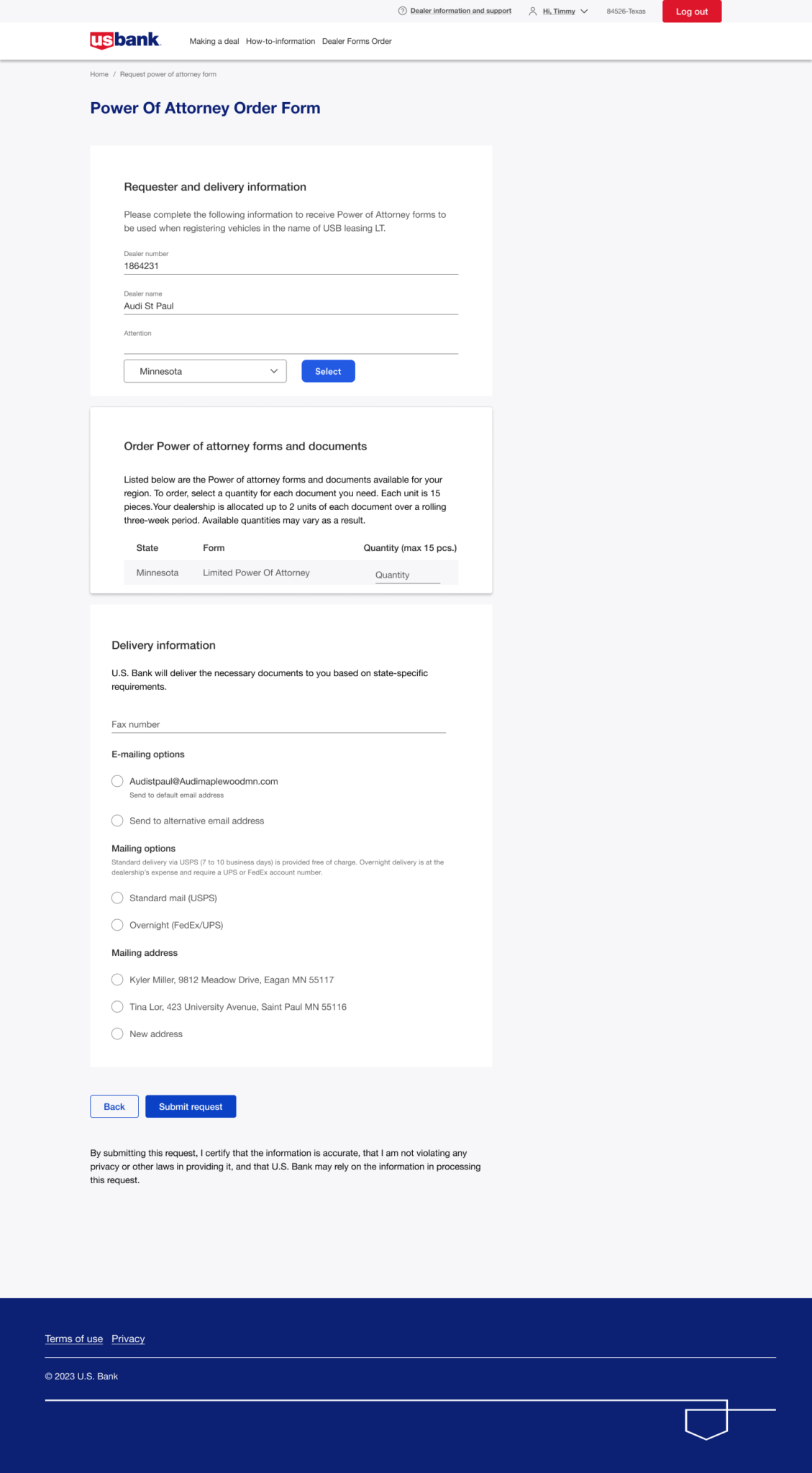

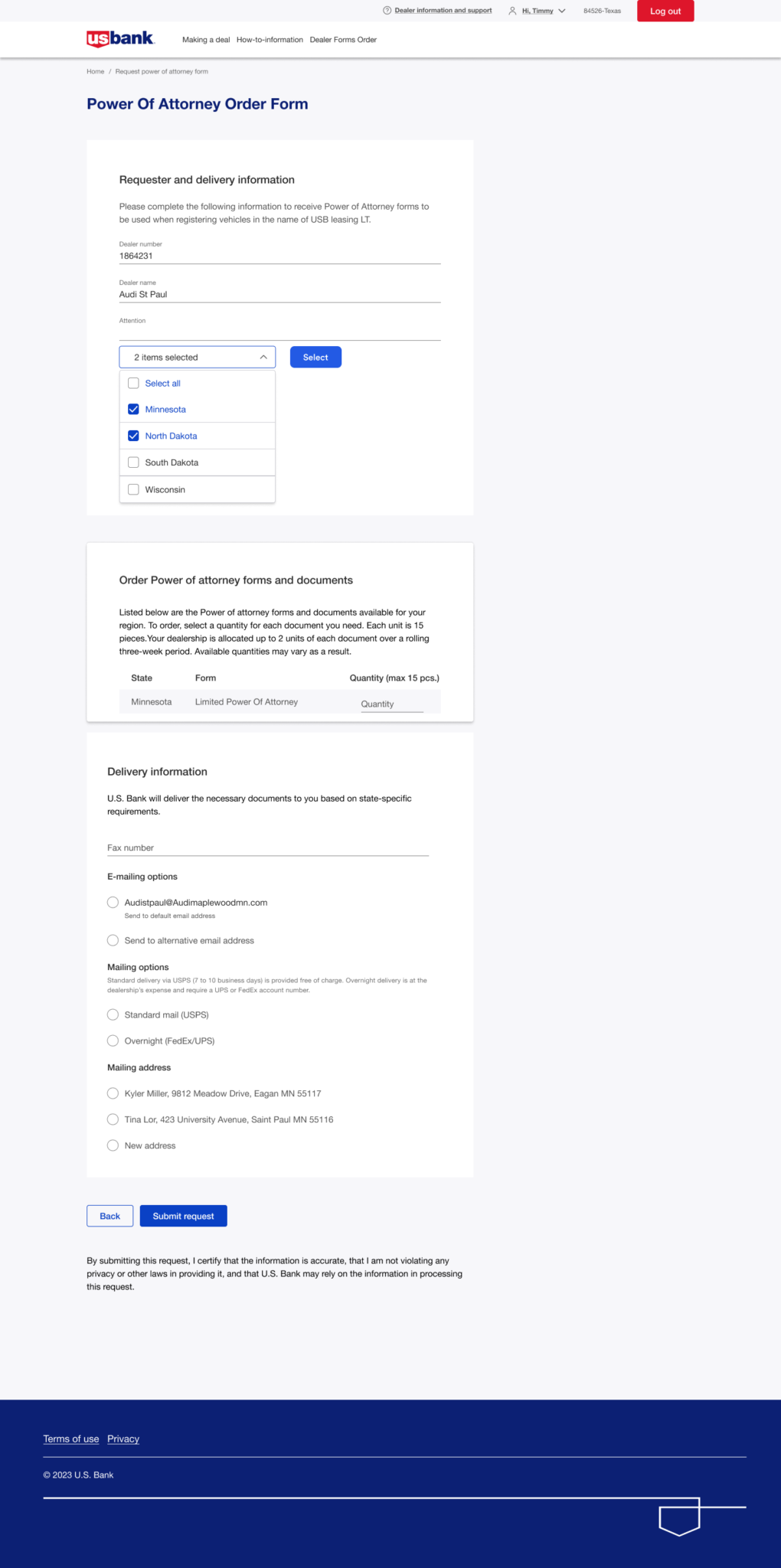

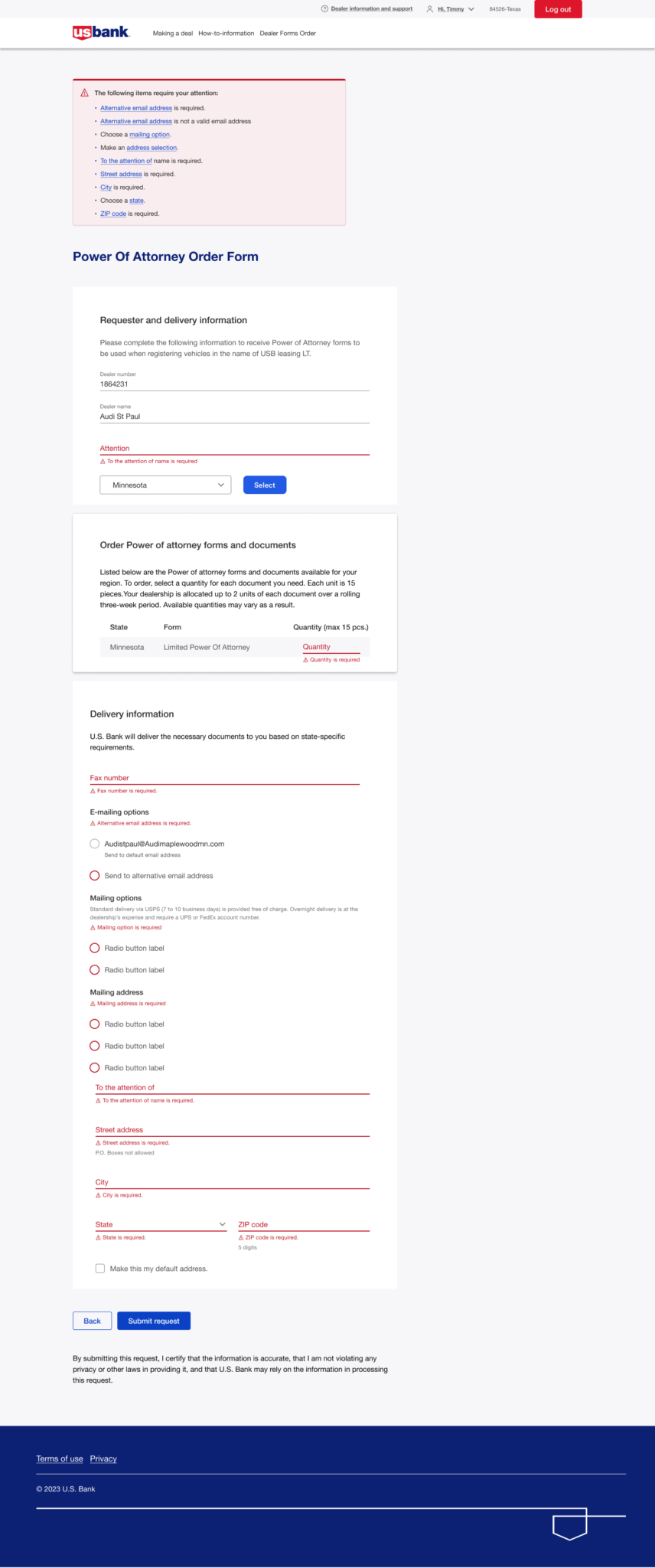

Based on the provided wireframes, the digital POA request process was designed with the following key screens:

A. Request Form Page

Users select the state-specific POA form.

Input fields for dealer number, dealer name, and attention details.

Users can specify quantity (maximum 15 pieces per request).

Multiple state selection option (e.g., Minnesota, North Dakota, etc.).

B. Delivery Preferences Page

Users select delivery method: standard mail (USPS) or overnight shipping via FedEx/UPS.

Option to enter alternative email addresses for document delivery.

Ability to save frequently used addresses for future requests.

C. Fulfillment Team Request Review Page

Displays all pending POA requests submitted by dealerships.

Options for fulfillment team to approve, reject, or request more details.

Allows fulfillment team to add notes explaining their decision.

D. Dealer Request Status Page

Displays real-time status updates of submitted requests.

Dealership users can see whether their request was approved, rejected, or requires more information.

Ability to send additional information or respond to the fulfillment team’s notes.

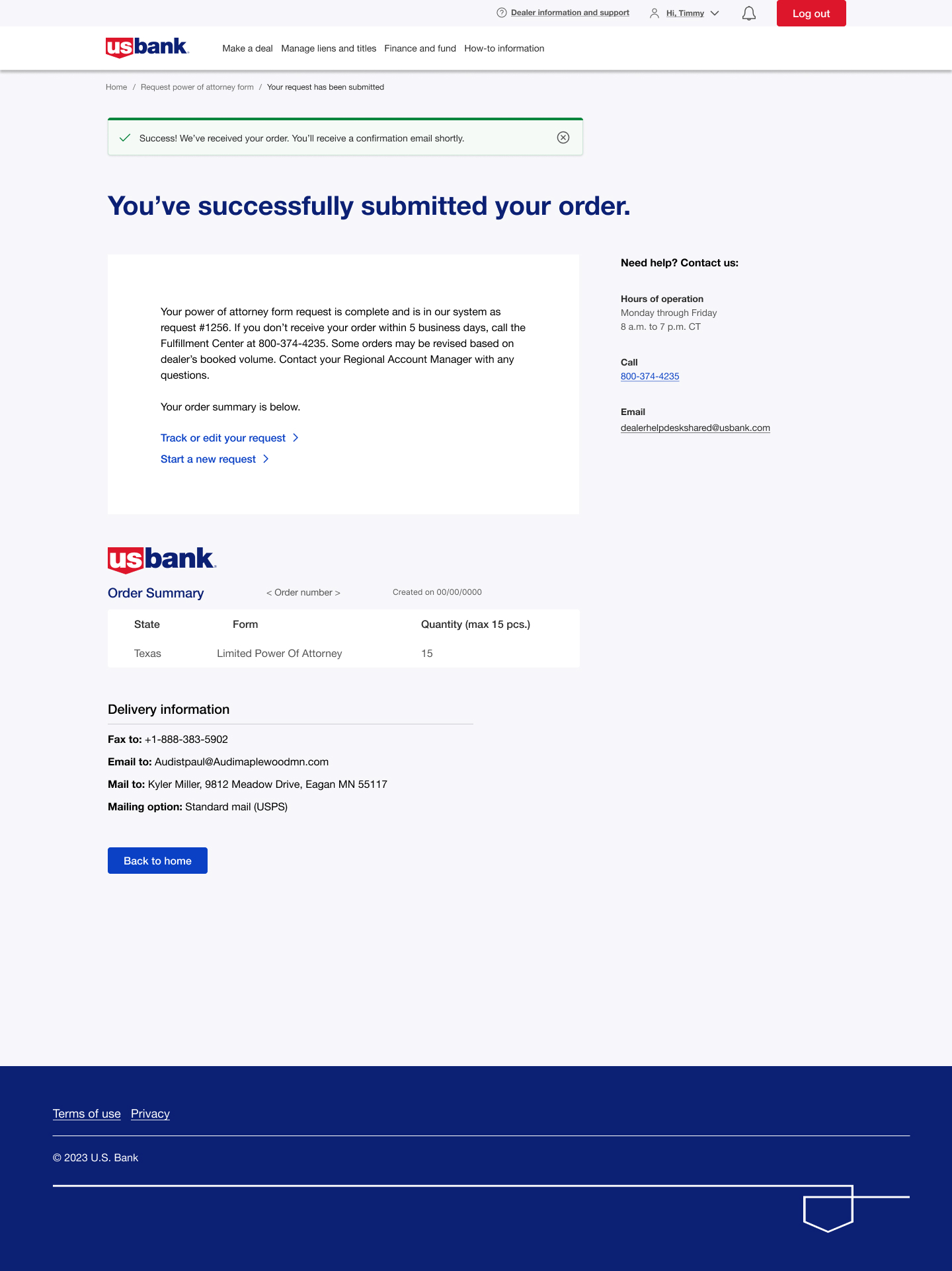

F. Confirmation & Tracking Page

Displays order summary, including order number and request details.

Users receive confirmation that their request is in process.

Tracking feature allows users to check request status and estimated delivery times.

G. Error Handling & Validation

Real-time validation for required fields (e.g., missing email, invalid ZIP code).

Error messages guide users to correct form entries before submission.

Prototyping & Usability Testing

Low-fidelity wireframes were created and refined through feedback sessions. High-fidelity interactive prototypes were tested with dealership users. Based on user feedback, form fields were simplified for a better experience, request tracking status was added for transparency, and auto-fill was implemented using dealership credentials.

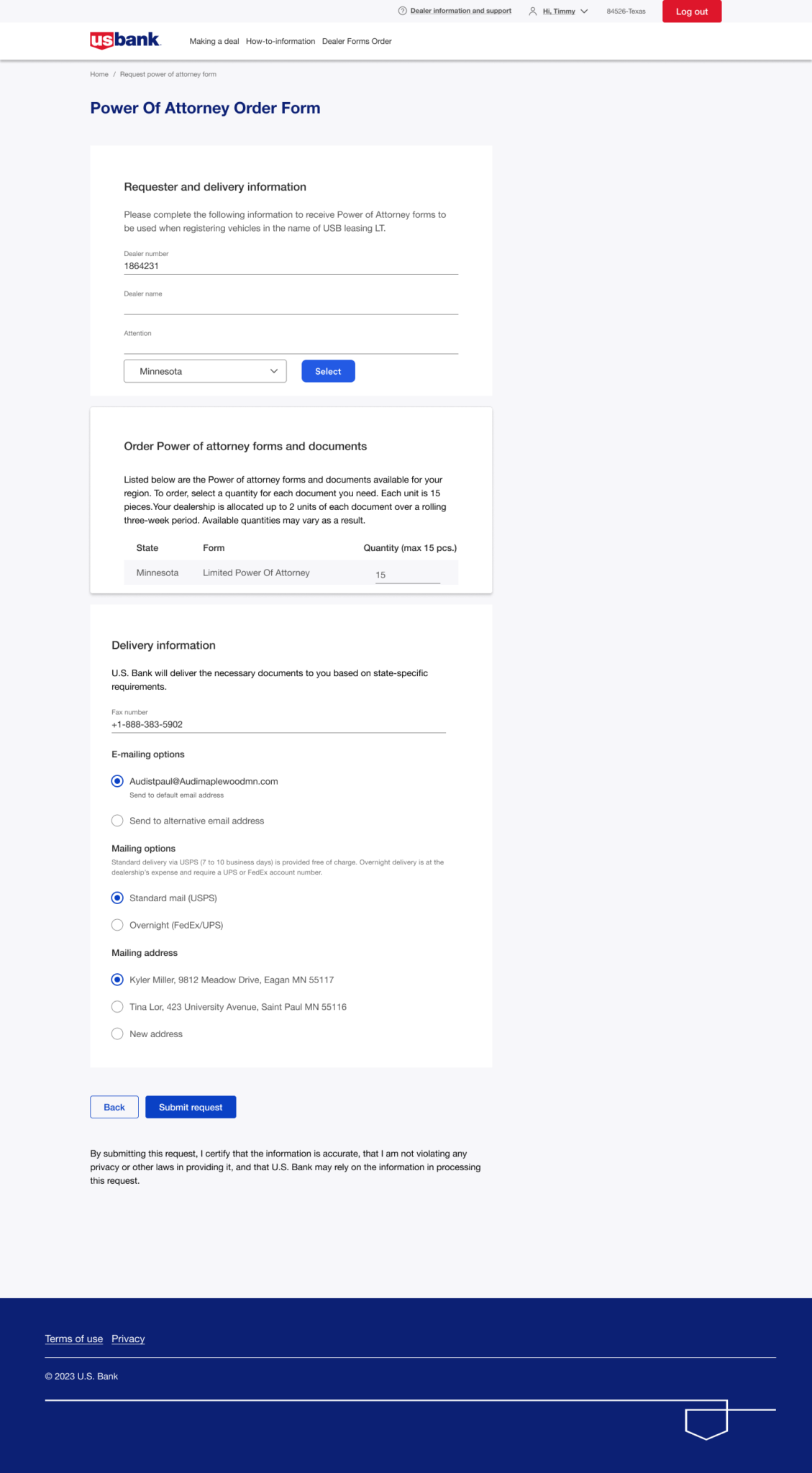

High-Fidelity Clickable Prototyping & User Testing

To validate the design and ensure an optimal user experience, high-fidelity interactive prototypes were developed and tested with dealership users.

Prototype Development:

Designed clickable high-fidelity prototypes replicating real-world interactions.

Ensured visual consistency with branding and user interface guidelines.

Included key workflows, such as requesting Power of Attorney forms, tracking requests, and auto-filling dealership credentials.

User Testing Process:

Conducted moderated usability testing sessions with dealership users.

Observed user interactions, pain points, and overall usability.

Gathered qualitative and quantitative feedback on navigation, form simplification, and request tracking.

Key Insights & Iterations:

Simplified Form Fields: Users found lengthy forms overwhelming, so redundant fields were removed.

Enhanced Transparency: A request tracking status feature was added for better visibility.

Auto-Fill Implementation: To streamline the process, dealership credentials were auto-populated, reducing manual input.

Final Validation:

Conducted A/B testing with different versions of the prototype.

Ensured seamless integration with existing dealership and bank systems.

Received positive feedback on usability, efficiency, and overall experience.

The insights gathered from high-fidelity prototype testing directly influenced the final implementation, ensuring a user-friendly and efficient solution.

MVP Development & Final Solution

All scenarios were designed to deliver a complete MVP. The final solution streamlines the process for requesting Power of Attorney forms, ensuring efficiency and ease of use. Here are some key high-fidelity screens for reference.

HFinal Implementation & Impact

An agile development approach enabled iterative releases with continuous user feedback. Compliance and security measures ensured regulatory adherence, while seamless integration with dealership and bank systems streamlined operations.

Results & Benefits

Faster Processing: POA request turnaround time reduced from days to minutes.

Increased Efficiency: Eliminated manual paperwork and errors.

Enhanced User Experience: Seamless, trackable digital solution.

Better Communication: Improved collaboration between dealerships and fulfillment teams.

Cost Savings: Reduced expenses on faxing.

MVP Development & Final Solution

All scenarios were designed to deliver a complete MVP. The final solution streamlines the process for requesting Power of Attorney forms, ensuring efficiency and ease of use. Here are some key high-fidelity screens for reference.

6. Conclusion

The digitalization of the POA form request process significantly improved efficiency and user experience for dealership users. By eliminating the need for fax and mail requests, the project streamlined operations and provided a modern, trackable, and secure method for managing POA requests. The new workflow introduced clear communication between dealership users and fulfillment teams, ensuring transparency and efficiency in the request process.